In this article, we will explore the UPI for small business 2025.

The business has faced dramatic changes in terms of operation and payment due to the covid-19 pandemic and changes have given new opportunities and growth prospects.

Digitalization has a wide impact on every individual, business, and all types of institutions but local and small businesses benefit a lot in terms of cash flow.

Digital payment establishes a clean economy and fast and secure payment.

India Unified payments interface is the flagship digital payment platform that was its highest ever transactions in April 2022 at 5.58 billion, amounting to Rs 9.83

The unified payment interface developed by the National Payments Corporation Of India is an instant real-time payment system.

UPI contributes a lot to the cash flow management of Indian small and local businesses.

As per the report, 40% of all transactions in India are digital and it will reach $ 10 trillion by 2026.

UPI for small business 2025

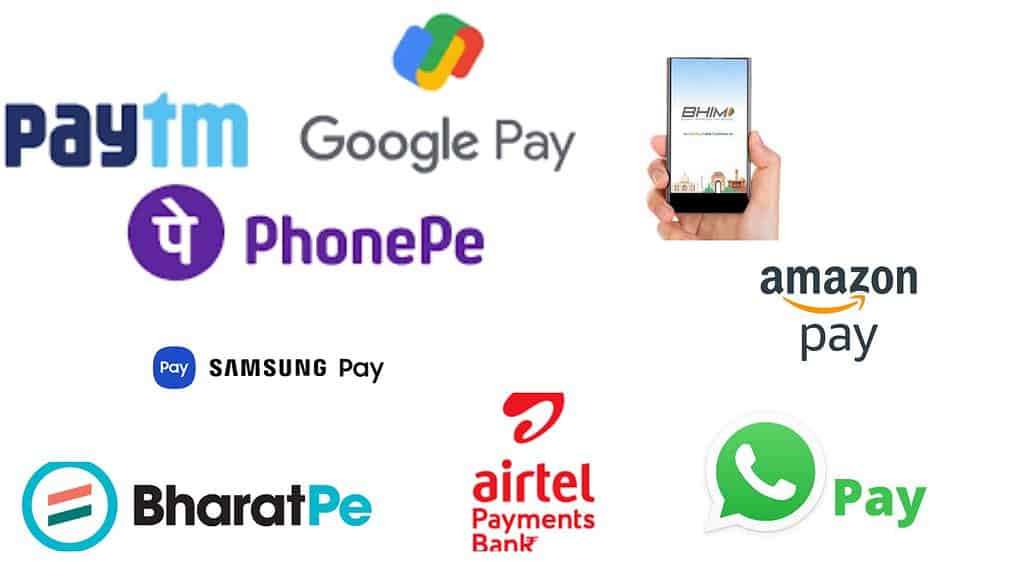

Here I am sharing UPI Apps that are wiring small businesses and setting a new highest.

Digital technology will be the future of business and we have seen shifting business in a new era like digital marketing, work from home, and digital payment.

Digital payment dramatically registers new heights during the COVID-19 pandemic and still increasing day by day.

Per the PhonePe pulse -BCG digital payment will constitute around 65% of all payments by 2026, up from 40% today.

1. Google Pay: Transforming Digital Payments Worldwide

Google Pay is a mobile payment service developed by Google and introduced in 2018.

Google has a strong market reputation, customer acceptance, and business throughout the world, and the company is diversifying its business into digital payment services.

Google Pay is suitable for all digital payments and enables users to make payments with Android phones, tablets, or watches.

You can make payments in small and large sizes within minutes.

Google Pay now has 150 million people across 40 countries using Google Pay.

Google Pay keeps innovating new digital payment experiences and ensuring Google Pay works smoothly both on the merchant and financial institution side.

Google Pay dominates the Indian digital payment space.

2. PhonePe: Redefining UPI Payments with Indian Innovation

PhonePe is an Indian digital payment and financial technology company, founded in December 2015, headquartered in Bengaluru, Karnataka India.

PhonePe is growing constantly and keeps focusing on new opportunities like bike insurance and many more to acquire more users and build the business.

PhonePe is most suitable for UPI payment, insurance, investment, phone recharge, gas recharge, payment of electricity bills, and all types of store payments and accepts payment.

PhonePe launches smart speaker for payment tracking.

PhonePe two-wheeler insurance policy sales have reached one million since its launch.

The company has 400 million trusted registered users and is accepted at 30+ million stores across India.

3. Paytm: Revolutionizing Digital Finance and Beyond

Paytm is a digital payment and financial technology company founded by Vijay Shekhar Sharma in 2010, headquartered in Noida, Uttar Pradesh.

Paytm has a strong customer base in India, a market reputation, trust, and a satisfied user base.

Paytm offers a savings account without any opening charges or credit cards.

Paytm is serving in booking movie tickets, flight tickets, bus tickets, all types of recharges, purchase of stocks, and many more.

Paytm has more than 20 million merchants & businesses and more than 300 million Indian users.

4. BharatPe: Fastest-Growing Fintech in Indian Cities

BharatPe was founded in 2018 by Ashneer Grover and Shashvat Nakarani, headquartered in New Delhi.

BharatPe has expanded its network in 400 Indian cities and towns.

BharatPe is India’s fastest-growing digital payment and financial technology company.

5. BHIM App: India’s Government-Backed Digital Payment Solution

Bhim App was developed by the National Payments Corporation Of India and launched by the Honorable Prime Minister of India, Narendra Modi on 30th December.

BHIM App is a government-owned digital payment technology with a strong market presence and the company growing its market share in India.

6. Airtel Payment: Trustworthy Banking and Recharges

Airtel Payment Bank was founded in 2017 and is headquartered in New Delhi.

Airtel Payment Bank is a growing and trusted payment bank in India.

Airtel Payment Bank has 11.5 crore users using its unique digital technology, retail-based distribution network, and a merchant base of over 80 million.

Airtel Payment Bank offers all types of recharge, and bill payments, and accepts deposits.

7. Amazon Pay: Seamlessly Integrating E-Commerce and Payments

Amazon Pay is a digital payment technology company owned by Amazon and was founded in 2007.

Amazon’s key focus is on giving users the option to pay with their Amazon accounts on external merchant websites.

Amazon Inc. is the world leader in the e-commerce business and is now the company is doing great in digital payment technology.

As per the report, more than 85 lacs of small-scale and medium enterprises are using Amazon to pay for their businesses.

8. Samsung Pay: A Global Leader in Mobile Payment Technology

Samsung Pay is a mobile payment and digital wallet service by Samsung Electronics, founded in August 2015.

Samsung has a great market reputation, trusted customer base, and worldwide presence so Samsung’s digital payment technology will be more trusted and growing.

Samsung Pay is headquartered in Burlington, Massachusetts, United States.

Amazon Pay has 2.5 million users now and operates in 20 countries.

9. WhatsApp Pay: Mark Zuckerberg’s Entry into Digital Transactions

WhatsApp Pay is owned by Mark Zuckerberg and WhatsApp Pay started its operation in 2018.

Facebook WhatsApp pay will increase its market share in the coming days because the company has a strong brand positioning and a trusted business network.

WhatsApp has a huge customer base and trusted brand value and the company has now entered the digital payment market.

WhatsApp Pay facilitates payment services to small businesses and users to make transactions fast and clear.

Wrapping Up

Now you can see how the digital payment service provider serves small and medium enterprises and facilitates service to users.

Digital payment become a key factor for small business success and cashflow management.

Digital payment promotes a clean economy and reduces paper use.

Digital payment growth will keep on and create more facilities for entrepreneurs.