10 Methods Of Accounting and Finance For Your Small Business will explore more about types of financing for business.

Businesses need funds for long-term growth and achieving sustainability and reliability.

Article 10 methods of Accounting and Finance for Your Business will be insightful and explore the source of fundraising for your business.

There are many ways businesses can raise funds for expansion, growth, asset purchase, and achieve success height.

Creative business ideas promising businesses and sustainable innovations must get boosted so that changes can take place for the betterment of nations and peoples.

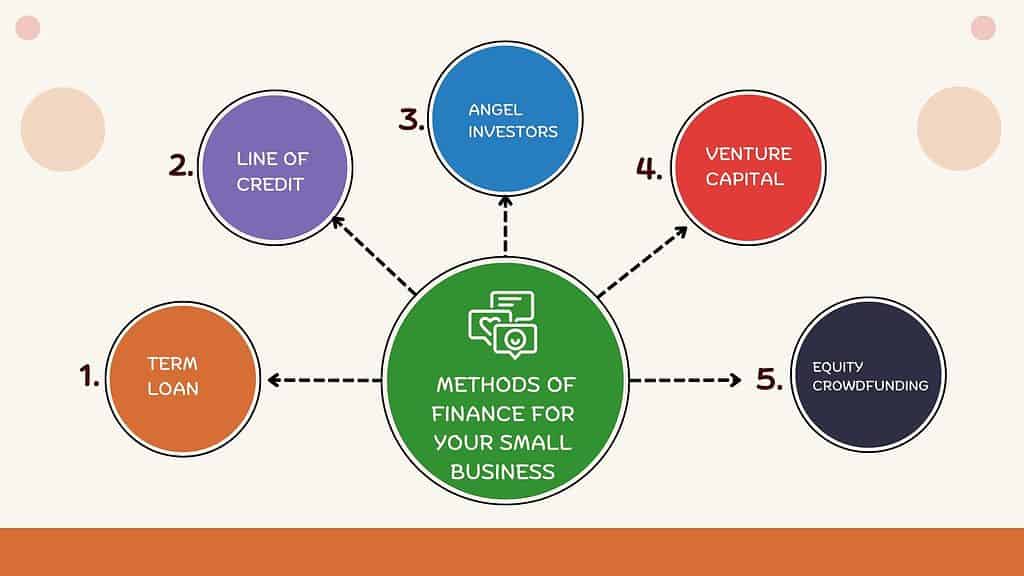

10 Methods Of Accounting and Finance For Your Small Business: Methods Of Finance For Your Business

Here we have shared 1o methods of financing for your business to keep growing, expanding, acquiring opportunities, and creating brand value.

Starting a business, or running a business is not enough you need funds to make your business stable and keep growing in the long term.

Here we have shared 10 methods of accounting and finance for your business, so that businesses keep growing, creating value, and contributing to employment generation and the GDP of the nation.

1. Methods Of Finance For Your Small Business: Term Loan

The first method for small business financing is a term loan is a lump sum repaid over a fixed time that can help your business to grow.

A term loan is a monetary loan in that a payment period is defined and interest rates are usually unfixed.

The term loan period can be 1 year to 10 years but in some cases go up to 30 years.

2. Methods Of Finance For Your Small Business: Line Of Credit

The second method of finance for small businesses line of credit, in this method funds, are available when you need money for your business operations and to manage your business.

A line of credit is a credit facility offered by a bank, NBFC, and other financial institutions to businesses or individual customers as per the requirement of funds.

3. Methods Of Finance For Your Small Business: Angel Investors

Angel investors are individuals who invest their own money in promising startups.

These Angel investors invest in the early age of the company.

Angel investors are investing for the shake of ownership equity or convertible debt in the company.

Now the Indian investment network connects entrepreneurs with Angel investors based in India and even around the globe.

4. Methods Of Finance For Your Small Business: Venture Capital

Another method of financing small businesses, venture capital financing is through professional investment groups.

Venture capital supports startups that have high growth potential.

Venture capital is a form of private equity financing for emerging businesses.

5. Methods Of Finance For Your Small Business: Equity Crowdfunding

Equity crowdfunding is where the public can invest in your business.

Equity crowdfunding is a form of fundraising for businesses without taking any new debts.

6. Invoice Financing

An advance on the invoice that you have issued and instant support to your business for better economic mobility.

Invoice financing is offered by the bank to better cash flow for the business.

7. Cash Flow Financing

Cashflow financing is a type of debt financing in which banks lend funds, especially for working capital management.

8. Peer To Peer Lending

Crowdfunded loans are where an entrepreneur can obtain a loan directly from individuals without any financial institutions or middlemen.

Peer to Peer lending also known as P2P lending is a financial innovation that connects and communicates verified individuals with an investor or another individual.

9. Incubators and Accelerators

Development schemes to uplift and boost small businesses These programs run for certain industries and recommendations from committees.

10. Friends And Family Loans

When your close one lends you money this form of lending requires no documents but your image must be good.

In India, small businesses much depend on such types of lending because it is an easy, fast process, and freedom of repayment in any amount.

Why do Businesses Need Financing?

Startups and promising businesses need financing to grow, create employment, contribute to GDP, motivate others, and problems solving.

Finance can help businesses in many ways like enhancing working capital, expansion, purchasing new assets, replenishing a stock, hiring more staff, or refinancing to pay off existing debt.

Low personal wealth

Major assets purchases

Working capital

Business expansion

Financing gives businesses the oxygen to survive, grow expand their reach, and create a successful enterprise.

We have seen many startups fail, and lack funds, we can take Tesla as an example, if the company failed to get financed, we never see such an innovative and valuable company today.

So financing is a must for startups to keep building market value and solving people’s problems.